Table of Content

If you decide to go for long-term rentals, will it be a multi-family home or a single-family home? You should choose an investment strategy and property type that are in line with your real estate investment goals. At this stage, you are still putting together a plan for buying a second home to rent out. Therefore, after you have researched your mortgage options, you need to look into the rental strategy and what type of investment property is best for you. You can do that through researching the real estate market in the specific location you are looking into.

Get in touch with an experienced real estate agent to help you begin the journey of buying a second home. Mashvisor has tools like sortable listings on all types of properties. Our heat maps will show you where the good deals on properties are and help you prioritize. Mashvisor’s tools will then help you analyze any property of interest.

The 500 Greatest Songs of All Time

Now, an owner may use it anything higher than two weeks as well. Although in order to treat the property as a second home, no rental income may be used to qualify the buyer. There’s nothing wrong with receiving as much rental income as the owner can get, but Fannie Mae will not allow the rental income for mortgage qualification. Conversely, if the rental income is needed to qualify the buyer, then it must be treated as a rental property. Therefore, more down payment and a higher interest rate is required. Buying a second home and renting the first requires extensive research and planning.

HELOCs have variable rates and are more often used for a variety of expenses over time. A cash-out refinanceis when you replace your current mortgage with a new, larger mortgage so you can access cash by accessing your home equity. So, you’ve decided to buy a second home and rent the first one out — great, now you have to figure out the steps needed to make it happen. Funding the purchase of your second home, becoming a landlord, and understanding the financial implications of multi-homeownership, sounds like a lot.

What Are the Costs of Buying a Second Home to Rent Out?

Many people who own a second property to rent out may not consider themselves buy to let investors if they only let the property out for shorter periods of time. With variations in house prices, rental yields, and tenant demand, it’s vital to research the best places to invest in property. While buy to let mortgages and stamp duty are likely the biggest expenses you will pay, there are plenty of upfront and ongoing costs to consider.

Just be sure you can pay back the loan or you risk losing your home. Hiring a property manager to deal with your tenants and any issues that arise can relieve a ton of stress. And especially if you’re planning on moving to another state or city, a property manager can take care of everything. Of course, the deductions for mortgage interest and real estate taxes are only relevant if you itemize your deductions. If you opt to take the standard deduction, these deductions wouldn’t apply. Here’s a quick rundown of the benefits and drawbacks of a second home or rental property, from a tax perspective.

Phoenix Real Estate Market 2018: A Good Place to Invest?

You can currently rent the movie in HD for $3.99, or purchase it for $14.99. If you haven’t seen the original Avatar, or you want to catch up on the story before heading to the theater, you can watch the 2009 film online right now on a variety of platforms. Those who have a Disney+ subscription can stream the original Avatar movie at home. Disney+ doesn’t offer a free trial, but a subscription costs as low as $7.99/month for the ad-supported plan, or $10.99/month for the ad-free package. The LBTT additional homes change is predicted to raise an additional £34m per year. On the downside, you’ll have to be a landlord—which includes time and energy.

When you're ready to buy a second home, then, it's important to know whether you're purchasing a second home or an investment property. A title search to make sure there are no liens against the investment property that you might end up committing to unknowingly. Last but not least, agents have the right professional connections.

Second home vs. investment property

Down payments are another potential challenge for buyers purchasing second homes or investment properties. But most lenders will require that 25 percent down payment for investment properties, Jensen said. Having 2 homes may also mean having 2 mortgages, which can potentially create a financial burden. Before buying a second home, experts suggest paying off high interest debt, creating a livable financial budget, and setting aside enough cash as a rainy day fund for personal emergencies. Speaking with a financial planner or property manager may be two good ways to understand the costs of keeping the first home as a rental.

Brown recommends looking at the place with a fresh set of eyes as if you’re going to sell it. Although you probably won’t need to make any major renovations as if you were selling it, you will need to make repairs like scraping and repainting peeling paint or fixing a leaky sink. Once your finances are in place, it’s time to get your home in rentable shape. Next, you need to double-check whether you can legally rent out your home by looking at your current loan agreement. Schwab Bank, in its sole discretion, will determine at any time the eligible collateral criteria and the loan value of collateral. One factor that may take you by surprise is the emotional attachment to your first home.

UK banks are closing client accounts held by established letting agents... Independent lettings agents are being invited to book a place at a monthly networking dinner... If you're looking to fund a home renovation project or a down payment on a new place, the equity in your home could help. In this article, we will discuss the best options when buying a second home to help bring in revenue even when you are not using it. Before buying a second home to rent out, you need to consider mortgage shopping.

Buying a second home involves a lot of work, not only in advance of buying but throughout the rental process and eventual sale. Finding a reliable team of professionals—an accountant, an attorney, a real estate agent, and possibly a property manager—can help. "More so even than your primary residence, successful second-home ownership is a team effort," says Hayden.

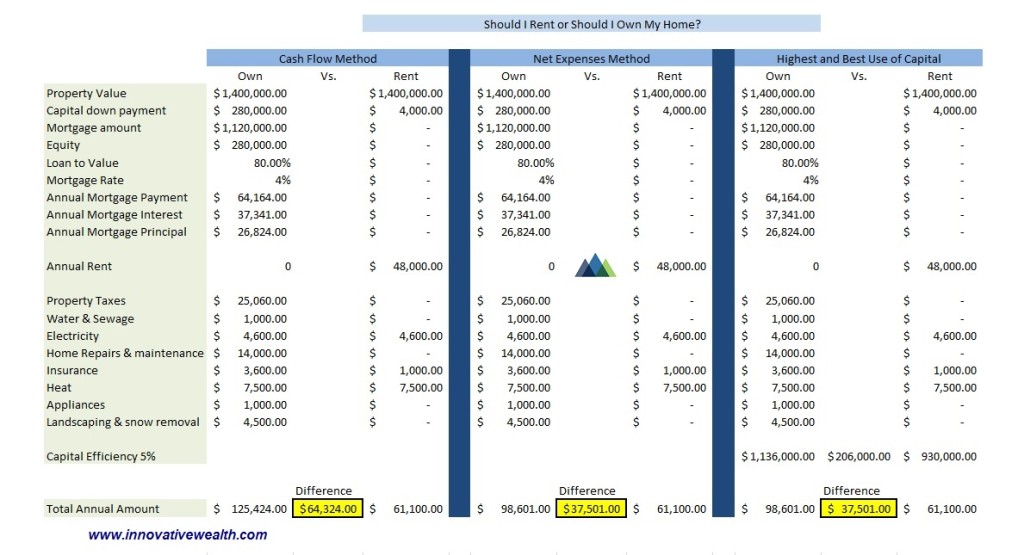

While there are financial benefits to investing in rental property, there are risks—tenants who don’t pay their rent and the headache of being a landlord—as well. You’ll need to weigh taxes, real estate appreciation, mortgage, and maintenance costs, and your desire to be a landlord when deciding if owning a rental is a wise financial move. Some landlords rent out homes at rates that offset the costs of the mortgage payments, expenses related to owning a home, and generate a profit.

If the mortgage payment is $900 per month , the home would have a positive cash flow of $350 per month. The higher interest rates provide some extra protection to lenders. Lenders will also require that buyers come up with a higher down payment -- usually at least 25 percent of a home's final sales price -- when they're borrowing for an investment property. Lenders believe that buyers will be less likely to walk away from the loans on their investment properties if they've already invested more of their own money in these homes. Every mortgage application you complete will involve you answering the question of how the property you intend to purchase will be used. The options include primary residence, second home, and investment property.

No comments:

Post a Comment